Investor confidence seems to be on the rise in the crypto market lately, and Bitcoin has benefited immensely from this positive trend. Consequently, there has been continued accumulation of BTC among large-scale investors despite the somewhat frustrating price action.

The price of the leading cryptocurrency could have ended below the psychological level of $70,000 in May, despite hitting the level a few times in the last two weeks of the month. The latest on-chain data suggests that confidence in Bitcoin has only grown stronger.

Is BTC ready for a price increase?

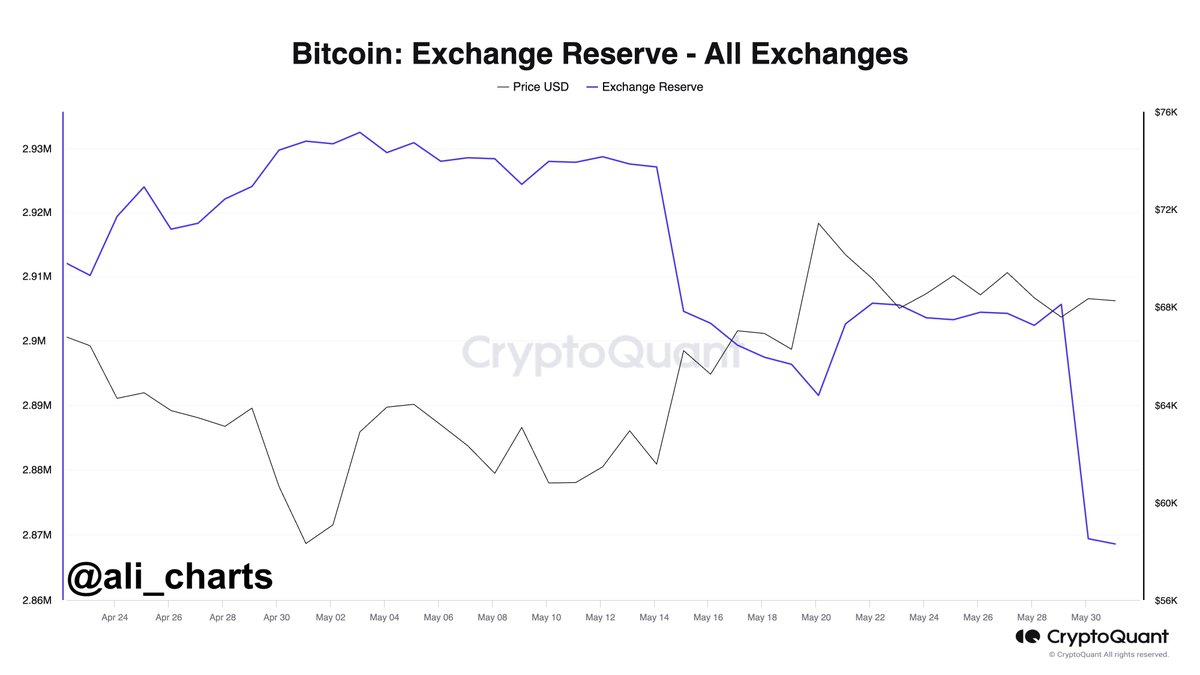

Prominent crypto analyst Ali Martinez shared via a message on the X platform that significant amounts of Bitcoin have made their way out of the centralized exchanges. This on-chain observation is based on the CryptoQuant Exchange Reserve metric, which tracks the amount of a given cryptocurrency in the wallets of all centralized exchanges.

Related reading

An increase in the value of the metric indicates that investors are making more deposits than withdrawals of a crypto asset (Bitcoin, in this scenario) on centralized exchanges. Meanwhile, if the value falls, it means that more coins are flowing into the trading platforms than into the trading platforms.

According to Martinez’s post, more than 37,000 BTC (worth approximately $2.53 billion) have been transferred from crypto exchanges in the past three days. This significant exodus of funds signals a change in Bitcoin investors’ sentiment and long-term strategy.

Although it is difficult to tell the exact reason behind the massive outflow from the stock exchanges, the movement of funds from trading platforms indicates an increase in investor confidence. This indicates that many investors may be convinced of Bitcoin’s future promise and therefore choose to store their assets in self-custodial wallets for the long term.

Moreover, the downward spiral of Bitcoin supply on centralized exchanges could trigger a bullish rally for the price of the leading cryptocurrency. The continued decline in BTC balances on the exchanges could result in a supply crisis.

For context, the supply crisis refers to a scenario or period in which the supply of a particular asset is lower than the demand for it, resulting in an increase in the asset’s value.

Bitcoin price at a glance

At the time of writing, Bitcoin’s price stands at around $67,489, reflecting a decline of 1.5% in the past 24 hours. This sluggish performance over the past day underlines the major cryptocurrency’s troubles over the past week. According to CoinGecko data, the BTC price has fallen by almost 2% over the past seven days.

Related reading

Featured image from iStock, chart from TradingView