On-chain data shows that 44.2% of all Ethereum investors are now carrying their coins at a loss, a sign that the bottom for the asset could be close.

The percentage of Ethereum holders that are losing money has skyrocketed recently

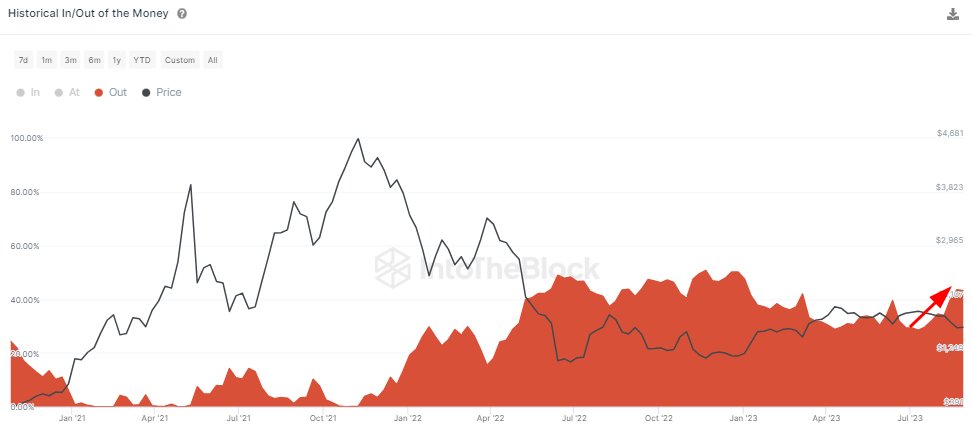

This is evident from data from the market information platform InTheBlockthe percentage of ETH investors losing money has grown sharply since the beginning of July. The relevant indicator here is the company’s ‘Historical In/Out of the Money’, which tells us about the percentage of Ethereum investors in gains and losses and those just breaking even.

The metric determines whether an investor makes a profit or a loss by looking at his address history to check the average price at which he acquired his coins. If the asset’s current spot price is less than a holder’s cost basis, then that particular holder will naturally carry its coins at a net profit.

Similarly, the fact that the cost basis is equal to and less than the spot price would imply that the investor is breaking even on their investment and holding at a loss, respectively.

Here is a chart showing the trend in the Ethereum In/Out of Money historical indicator over the past few years:

The value of the metric seems to have been going up in recent weeks | Source: IntoTheBlock on X

IntoTheBlock has only listed the data for the Ethereum investors with losses, as this is the number of interests in the current discussion. The combined percentage of investors breaking even and making a profit can also be derived from this value, as the total percentage must add up to 100%.

At the beginning of July, the share of underwater Ethereum holders was about 27%. However, it is visible on the chart that the indicator has seen a remarkable increase since then as the price of the cryptocurrency has registered a decline.

Today, the value of the indicator stands at 44.2%, which means that almost half of the Ethereum user base is holding their coins at a loss. In general, the more investors make a profit, the more likely they are to sell to reap those profits.

For this reason, asset corrections become more likely when an extreme majority of the market makes a profit. However, a large percentage of holders that take losses instead can have the opposite effect on the price, as they can lead to bottoms as profit sellers become exhausted.

Related reading: This could be the benchmark to watch for a Bitcoin bounce: Santiment

Since the start of the bear market last year, the highest value of the benchmark has been 50%, implying that exactly half of investors had suffered losses at the time. This value is not far from its current value, suggesting that Ethereum may have bottomed out.

If a similar loss rate hits the bottom this time around, ETH would first suffer a further downtrend, leaving enough investors underwater.

ETH price

Ethereum has continued to move flat lately; as I write this, it is trading at around $1,600.

Looks like ETH is still struggling to find any volatility | Source: ETHUSD on TradingView

Featured image of Kanchanara on Unsplash.com, charts from TradingView.com, IntoTheBlock.com