New data shows that Bitcoin (BTC) exchange-traded fund (ETF) inflows into the spot market have hit a new all-time high, as the crypto king approaches its $64,000 price tag for the first time in years.

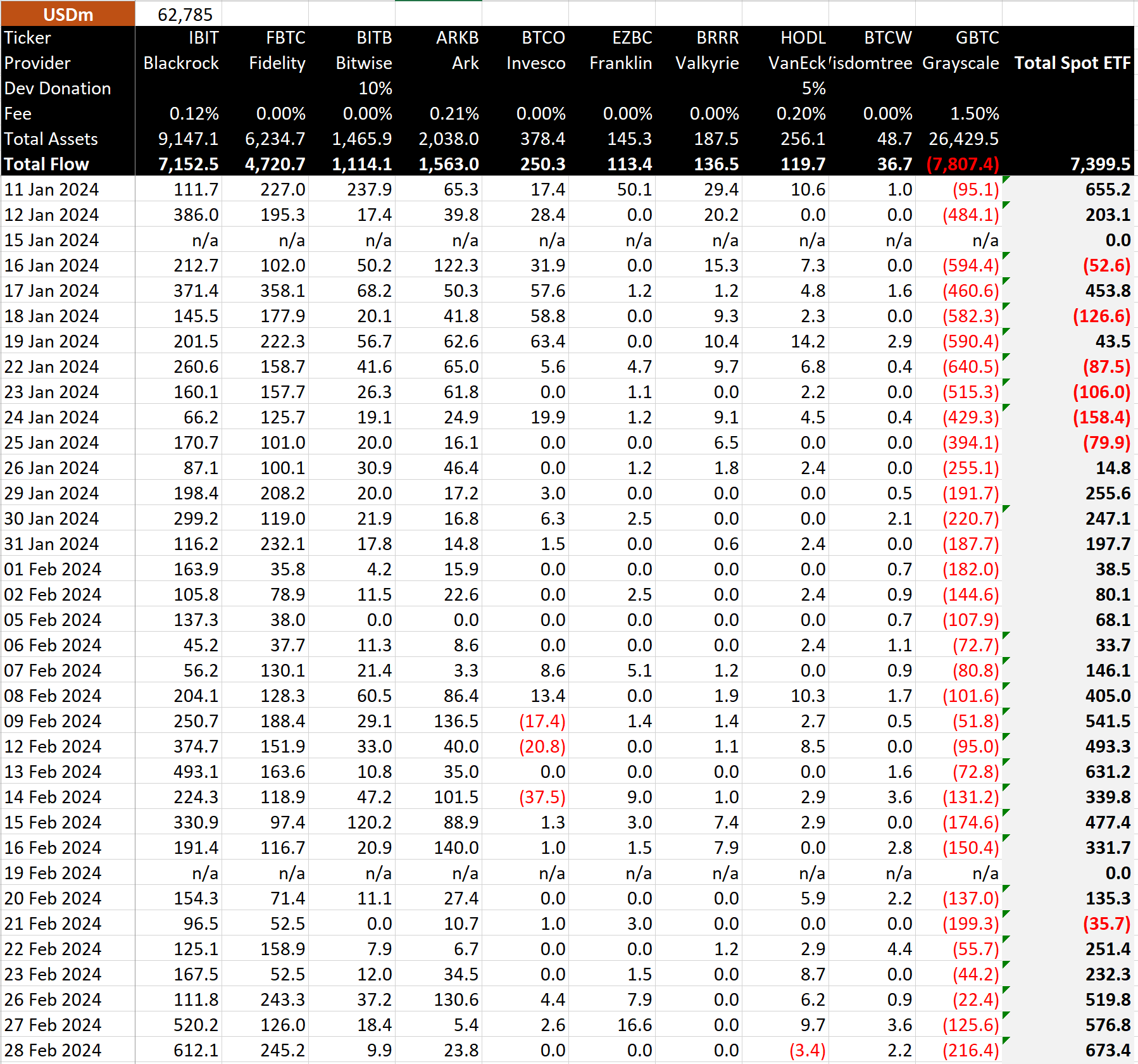

According to the analytical arm of crypto exchange BitMEX, powered by asset management titan BlackRock, Bitcoin is ETFs saw net inflows worth over $673 million in just one day – a new record.

“Bitcoin ETF Flow – February 28, 2024. All data in. Today was a record inflow day, with a net inflow of $673.4 million. This was driven by Blackrock, which also had a record day, with inflows of $612.1 million.”

Other spot Bitcoin ETFs that saw significant inflows include Fidelity, BitWise and Cathie Wood’s ARK Invest, according to the data. However, the data shows that Grayscale’s BTC ETF (GBTC) is experiencing significant outflows – to the tune of hundreds of millions of dollars.

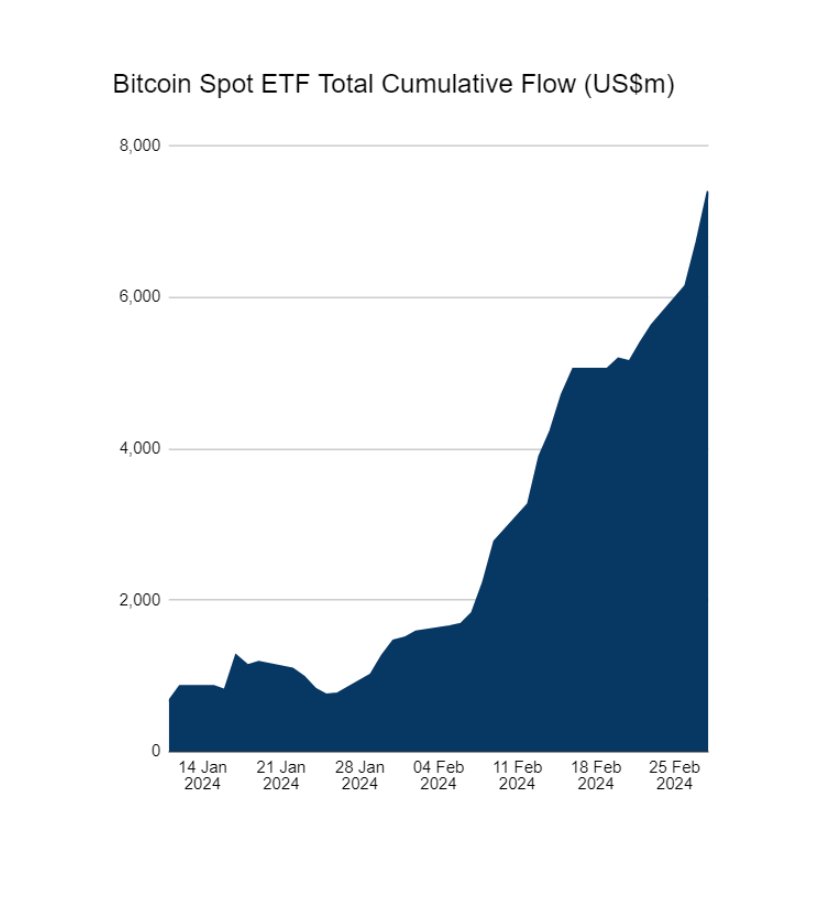

BitMEX research too finds that total net inflows of funds into Bitcoin ETFs since they were approved by the US Securities and Exchange Commission (SEC) in mid-January have reached $7.4 billion.

Bitcoin is trading at $62,143 at the time of writing, a gain of 1.84% over the past 24 hours. However, the top digital asset briefly reached $63,600 this morning, a level it hasn’t seen since 2022.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney