On-chain data shows that the percentage of PEPE investors currently in the green has fallen to 69% after the 26% plunge the memecoin has seen over the past week.

69% of all PEPE addresses are currently making some profit

In a new one after on

The analytics company’s metric measures whether a holder is making a profit or not by looking at the history of their address on the chain. Based on when the wallet acquired the coins, the indicator calculates the investor’s average cost basis based on the spot price of the asset at the time of those purchases.

If the current spot value of the cryptocurrency is higher than this average cost basis for any address, then that particular investor is currently making a net profit. IntoTheBlock categorizes such addresses as ‘in the money’.

Likewise, investors with a cost basis higher than the last price are considered out of the money. If the two values are exactly equal, this would obviously suggest that the holder has just broken even on their investment or is ‘at the money’.

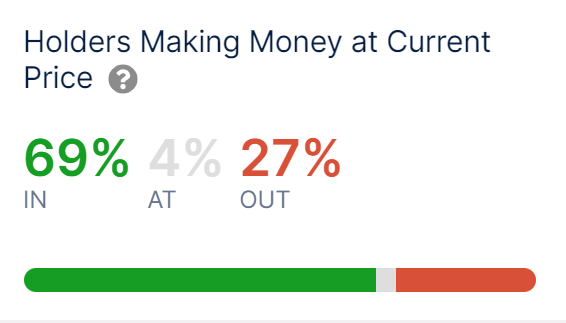

Here is the data shared by the analytics firm showing what this investor analysis currently looks like for PEPE:

The profit-loss status of the investors owning the memecoin | Source: IntoTheBlock on X

As visible above, 69% of the total addresses with PEPE have a higher cost base than the current spot price of the coin, while 27% are at a loss. 4% of investors are currently at their cost basis.

This profitability ratio is not that high considering, for example, 89% of Bitcoin investors are currently making a profit, according to IntoTheBlock data. The reason behind the lower profits for the memecoin is that its price has fallen sharply recently.

Historically, addresses in the green are more likely to sell to capture their profits. So if the market’s profit-loss balance is overwhelmingly in favor of profits, there could be a massive sell-off.

This obviously means that the likelihood of hitting a top increases as investor profits increase. However, a low percentage of investors making profits can be conducive to bottom formation, as profit selling is exhausted at these levels.

Currently, PEPE is neither dominated by green nor red investors. However, bull runs generally maintain higher profitability, so any cooldown could help prices recover.

Thus, the fact that investor profitability has returned to the 69% level for the memecoin could be a sign that a bottom is close if the bullish regime is to continue.

PEPE Award

PEPE has returned to the $0.0000050913 mark after falling more than 26% in the past seven days. The chart below shows the memecoin’s performance over the past month.

Looks like the price of the coin has witnessed a steep decline over the last few days | Source: PEPEUSD on TradingView

Featured image from Shutterstock.com, IntoTheBlock.com, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.