On-chain data shows that Bitcoin and the other top assets are currently losing heavily. Here’s what this could mean.

Investors of Bitcoin and other top coins are currently capitulating

This is evident from data from the on-chain analytics company Sanitationcould the current capitulation of traders seeing the largest assets in the market be a bottom signal.

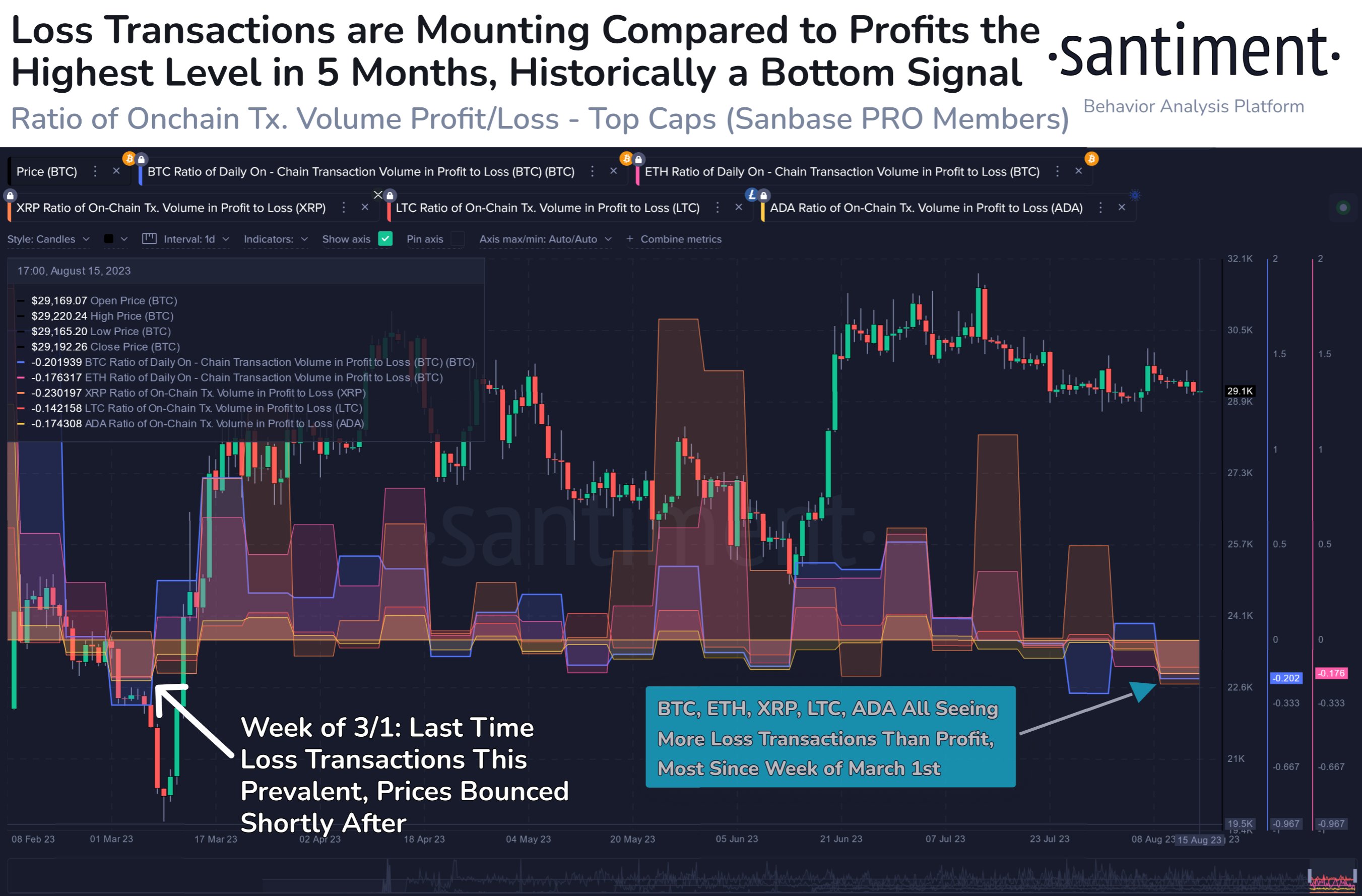

The indicator that matters here is the “ratio of daily on-chain trade volume in profit to loss” which, as the name implies, tells us how the profit-taking volume for a given coin compares to the loss-taking volume. now.

When this metric has a positive value, it means that the profit-taking volume is currently higher than the loss-taking volume. Thus, such a trend implies that the market as a whole is currently reaping profits.

On the other hand, the indicator with negative readings suggests that taking losses is currently the dominant behavior among the traders of the respective cryptocurrency.

In the context of the current discussion, the relevant assets are Bitcoin (BTC), Ethereum (ETH), XRP (XRP), Litecoin (LTC), and Cardano (ADA).

Here is a chart showing the trend in the trade volume to profit/loss ratio for these assets over the past few months:

Looks like the value of the metric has been negative for all these assets in recent days | Source: Santiment on X

As shown in the chart above, the value of the indicator for all of these top assets has recently dipped into negative territory. This realization of huge investor losses comes because the market as a whole has been unable to stage a significant rally.

It can be seen from the chart that these assets have seen investors capitulate at various times throughout the year, but the current capitulation has an interesting feature that was missing in these previous cases: loss taking is currently happening for all of these major cryptocurrencies.

It seems that traders as a whole have finally started to give up on the market after endless consolidation as they are ready to take losses to make their exit.

The magnitude of loss taking itself is also extraordinary, as the only other time this year where loss volume exceeded profit volume to this extent was way back in March.

Historically, investor capitulation has increased the likelihood of soil formation. And from the chart above, it can be seen that the capitulation of March also causes Bitcoin to bottom out.

The likely reason behind this pattern is that the investors who leave with losses are generally the weak hands, who had low conviction in the asset to begin with. In capitulation events, the coins they sell at a loss are picked up by the more resolute investors, thus giving the market a stronger foundation for building rallies.

It is possible that the large losses that Bitcoin and the others are currently experiencing could lead to a bottom as well, if historical priority is anything to go by.

BTC price

At the time of writing, Bitcoin is trading around $29,100, down 2% over the past week.

BTC continues to move inside a narrow range | Source: BTCUSD on TradingView

Featured image by Art Rachen at Unsplash.com, charts from TradingView.com, Santiment.net