Bitcoin’s recent downturn has prompted renowned crypto analyst Willy Woo to offer a new proposal perspective about the future trajectory of cryptocurrency. Woo’s analysis, based on the rise in the Bitcoin Macro Index, suggests an optimistic outlook for the leading digital currency, potentially signaling a crucial shift in market dynamics.

Revealing Bitcoin Double Pump Prediction

Willy Woo, a respected figure in the field of cryptocurrency analysis, recently shared insights that paint an intriguing future for Bitcoin.

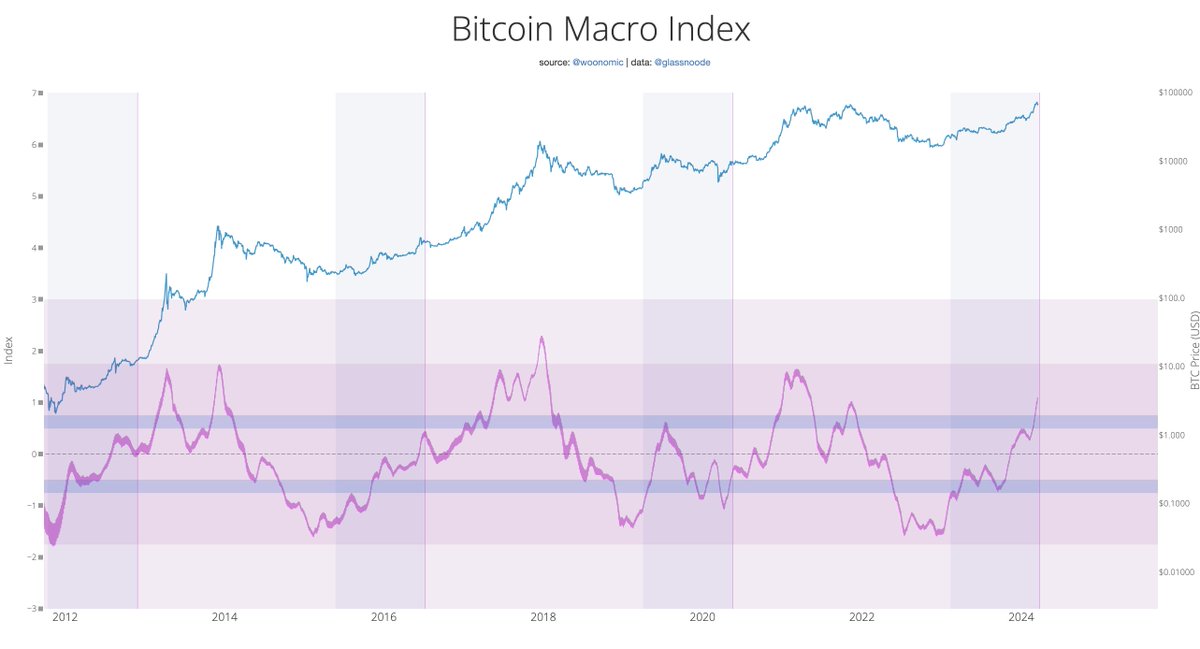

According to Woo, the remarkable rise in the Bitcoin Macro Index could mean more than just a recovery; it could be the precursor to a rare ‘double pump’ cycle.

Woo’s prediction draws parallels to 2013 market patterns and points to two significant price increases for Bitcoin in the coming years. He expects the first peak in mid-2024 and a second, even more substantial peak in 2025.

This double-up scenario, while historically unusual, is consistent with Woo’s analysis of current market conditions and Bitcoin’s intrinsic growth potential.

At the rate of #Bitcoin The Macro index is rising, I wouldn’t be surprised if we reach a top in mid-2024, which would indicate a double pumping cycle like in 2013… a second top in 2025. pic.twitter.com/i2a0V5ytPv

— Willy Woo (@woonomic) March 19, 2024

Navigating the bearish terrain

Meanwhile, the past week has not been kind to BTC, with the asset experiencing a decline of around 10%. This downward trend has continued over the past 24 hours, with Bitcoin’s value falling 4.9%, leaving its price at around $65,000 – a sharp drop from its recent peak above $73,000.

Amid this bearish price action, IntoTheBlock, a notable crypto analytics firm, suggests the $61,000 level as a critical demand zone, highlighted by the significant volume of Bitcoin purchased at this price.

This area is considered attractive for accumulation by institutional investors and large-scale traders, indicating a possible recovery in the near future.

Bitcoin is looking for support. But where will he find it?

The $61,000 range could be an important area to watch. 805,000 addresses have acquired over 466,000 BTC at this level, indicating a healthy appetite for $BTC around that level. pic.twitter.com/XYw7LSC6Ji— IntoTheBlock (@intotheblock) March 19, 2024

As Bitcoin navigates the current market challenges, cryptocurrency analyst Charles Edwards points out that a typical pullback during a Bitcoin bull run is around 30%.

With BTC experiencing its longest winning streak in history, a corrective dip to $59,000 or even $51,000 remains within the realm of possibility, according to some forecasts.

A normal Bitcoin bull run pullback is 30%. In December we were already in the longest winning streak in Bitcoin history. A 20% pullback here takes us to $59,000. A 30% pullback would be $51,000. These are all levels we should expect as possibilities.

— Charles Edwards (@caprioleio) March 19, 2024

These levels represent potential buying opportunities for investors looking to take advantage of Bitcoin’s cyclical nature and its expected rise following the pullback.

Featured image from Unsplash, chart from TradingView

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.