Bitcoin is currently trying to make another attempt at the $28,000 level. Here’s what on-chain data says about whether a retest can be successful.

Bitcoin-on-chain signals are not all positive at the moment

In a new after at

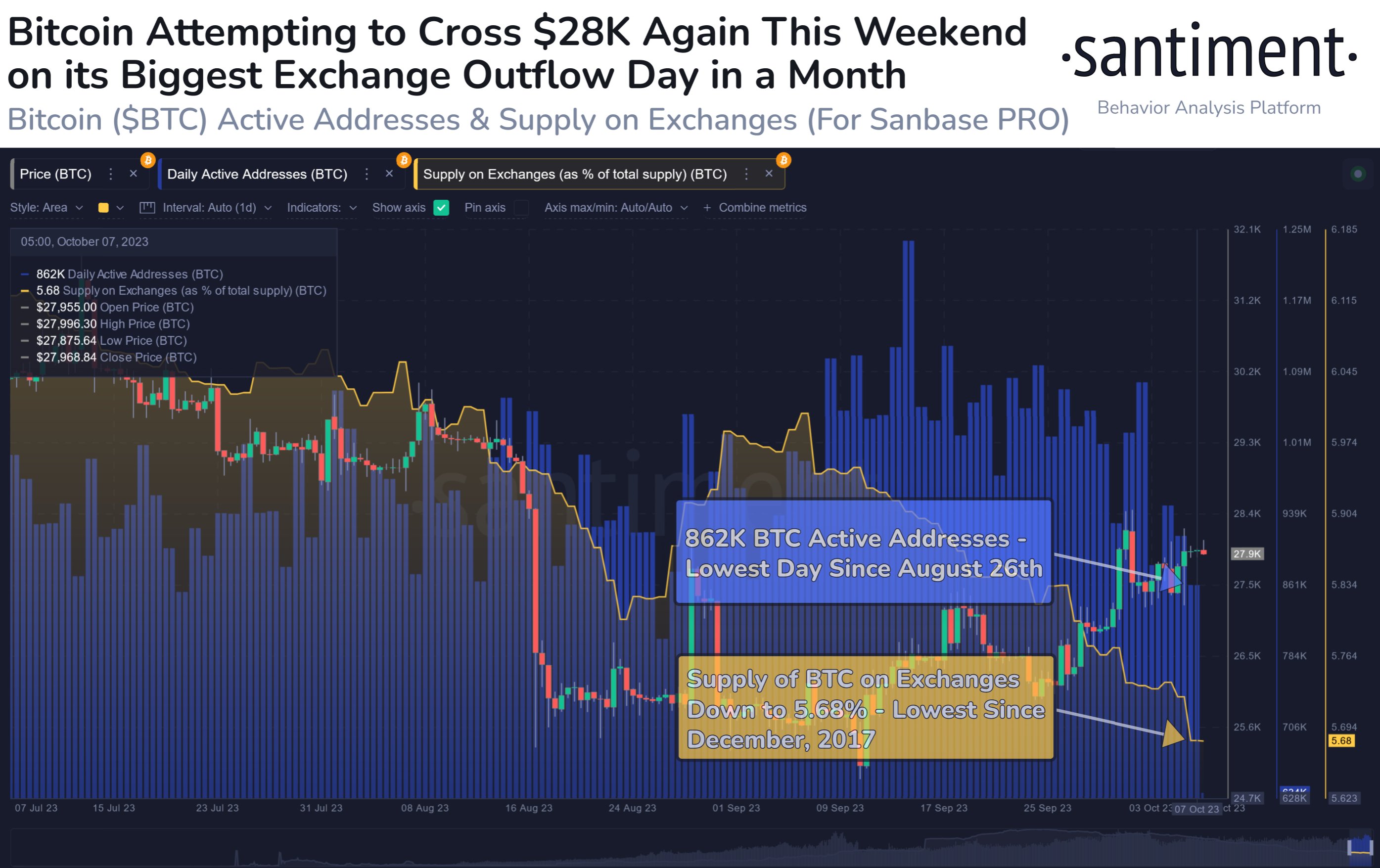

The first relevant metric is “exchange supply,” which tracks what percentage of the total Bitcoin supply is currently in the portfolios of all centralized exchanges.

When the value of this metric decreases, it means that withdrawals are currently taking place on these platforms. Generally, investors put their coins in their own wallets when they plan to hold them for a longer period of time, so these types of trends can have a bullish effect in the long term.

On the other hand, the reverse trend implies that there may be selling in the market as holders are currently depositing a net amount of the cryptocurrency onto the exchanges.

Here is a chart showing the trend in Bitcoin supply on exchanges over the past few months:

Looks like the value of the metric has been going down in recent weeks | Source: Santiment on X

The graph shows that Bitcoin supply on the exchanges has continuously decreased over the past month. This obviously suggests that the investors are transferring a net number of coins from these platforms.

As mentioned earlier, if investors pile on these withdrawals, the price could see a bullish impact, even if it won’t be visible until the long term. Therefore, these outflows may not be directly relevant to the current price increase.

However, another way to look at the net withdrawals is that there are at least no net deposits happening right now. As the chart shows, the recovery rally died out very quickly in late August as investors transferred a large amount of BTC to exchanges.

For now, it appears no such sell-off is happening, which could potentially continue the asset’s run. There is another indicator highlighted in the chart, but unlike the supply on the stock exchanges, it does not seem to show a positive trend.

This metric is the “daily active addresses,” which tracks the unique number of addresses participating in transaction activity on the blockchain. This indicator has now fallen to the lowest level since the end of August, implying that user interest in the asset is currently low.

Historically, rallies have only been sustainable if they have been able to attract a large amount of trader attention, as such moves typically require a large amount of fuel. Currently, the current recovery movement lacks such investor activity.

Furthermore, the $27,900 level is currently a point of major resistance because that is where the average cost basis of short-term holders lies, as CryptoQuant analyst Maartunn has noted.

BTC is currently retesting this level | Source: @JA_Maartun on X

All in all, it seems like a significant break above the $28,000 level in the near future could prove to be quite tricky for the cryptocurrency unless things can change quickly in terms of user interest.

BTC price

Bitcoin’s latest attempt could end in failure again as the price has now returned towards $27,600.

BTC has plunged during the last few hours | Source: BTCUSD on TradingView

Featured image of Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com, Santiment.net