Ethereum Exchange Traded Funds (ETF) are the talk of the town – and rightly so – after the US Securities and Exchange Commission (SEC) approved the investment products’ listing during the week. Meanwhile, the Bitcoin spot ETF market continued its revival on one side, marked by a second consecutive week of positive inflows.

This series of positive inflows represents a complete shift from previous weeks, when investment activity was dangerously low. However, this recent turnaround reflects a rise in investor confidence over the past two weeks.

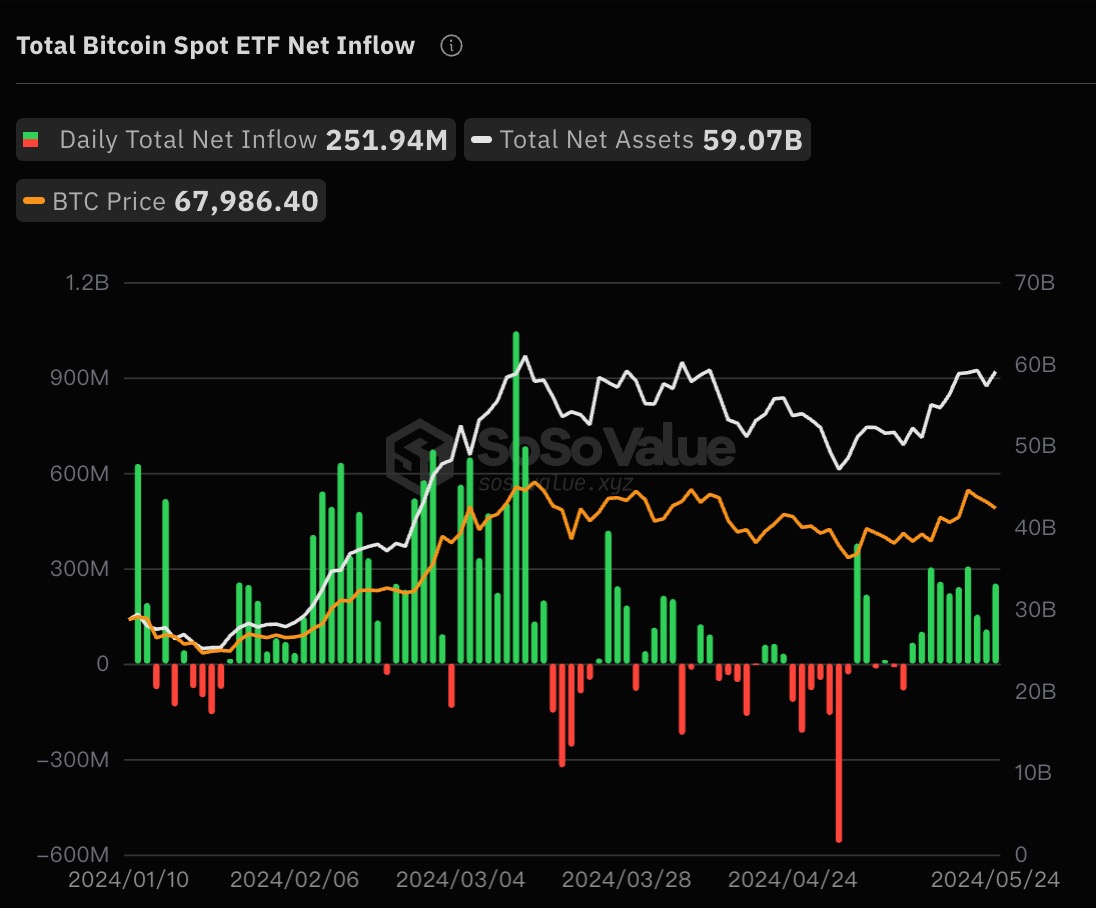

Bitcoin Spot ETF: $252 Million in Net Inflows in One Day

On Friday, May 24, the US Bitcoin spot ETF market saw another day of positive inflows, marking the 10th consecutive day of significant investment in these funds. According to data from SoSoValuethe market recorded total net inflows of approximately $252 million to close the week.

Related reading

Breaking this down, BlackRock collected a substantial percentage of the total daily investment, with the IBIT ETF seeing inflows of $182 million. Grayscale Bitcoin Trust (GBTC), on the other hand, did not raise any capital on Friday and ended the week with zero daily outflows and inflows.

Other ETF issuers such as Fidelity, Bitwise and ARK Investment also witnessed impressive inflows on Friday. Most notably, Fidelity’s FBTC came in second behind the BlackRock fund after raising about $43.7 million on the last day of the week.

More importantly, this positive day of inflows means the Bitcoin spot ETF market has amassed significant investments every day for the second week in a row. And after Friday’s trading session, net inflows over the past week totaled an impressive $1.06 billion.

This continued positive trend in terms of capital inflows suggests that investor confidence in Bitcoin ETFs may be back at an all-time high. The last time there was consistent positive capital inflow into these products, the Bitcoin price rose to a new all-time high.

With Ethereum spot ETFs about to start trading in the US, crypto exchange trading products seem to be in vogue right now. And they could be the catalyst the crypto market – and Bitcoin in particular – needs to resume the rest of the bull cycle.

Bitcoin price at a glance

At the time of writing, Bitcoin is valued at $68,868, refa price increase of 2.5% in the last 24 hours. According to data from CoinGecko, the major cryptocurrency is up 3% on the weekly time frame.

Related reading

Featured image from iStock, chart from TradingView