The co-founders of crypto analytics firm Glassnode believe Bitcoin (BTC) could soar to six figures early next year.

Glassnode co-founders Jan Happel and Yann Allemann, who share the handle Negentropic on the social media platform participation that the king crypto looks poised to significantly outperform gold on a rally towards $120,000.

“Will BTC Reach 98x the Price of Gold?

The BTC-Gold ratio seems ready to soar.

RSI (relative strength index) rising and greater than 50.

MACD (moving average convergence divergence) in bullish crossover and rising.

Fibonacci extensions indicate likely extension levels.

Will we see gold ~$1,200 and BTC ~$120,000? These levels are consistent with the predictions of (macroeconomist) Henrik Zeberg.”

Looking at the chart of the analysts, they predict that the trading pair BTC/XAU, i.e. the price of Bitcoin per ounce of gold, will rise to 98x the price of gold in early 2024, after the completion of the fifth wave of the Elliot Wave pattern (marked 1, 2, 3, 4, 5).

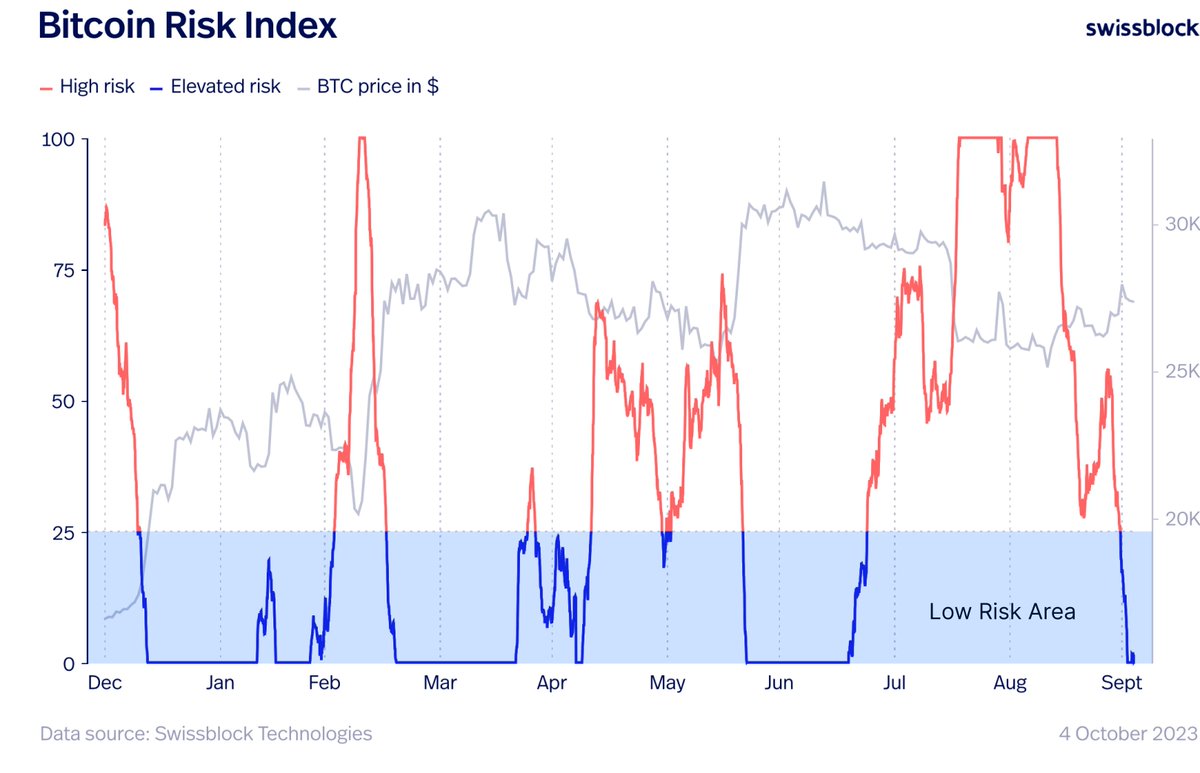

The analysts too participation that BTC’s risk signal, a metric that measures the risk level of a large price drop for the major crypto assets by market cap, indicates that BTC is finding support after a recent decline below the $28,000 level.

“BTC rose 6% on Sunday, but hitting a roadblock at $28,500 led to a 4.5% dip the next day. Nevertheless, the sharp decline in the risk signal below the high risk threshold suggests that a large decline is unlikely at this stage.”

The analysts remark that Bitcoin is once again testing a “neckline” on the monthly chart and is likely to enter a consolidation phase before heading back up.

A neckline is a trendline drawn under a head and shoulders pattern and is used as a key indicator of a reversal.

‘Third time’s a charm? BTC is consolidating above the neckline after finalizing the main bottom pattern. The DXY (US Dollar Index) appears to have peaked and is poised for a bigger decline. The structure for BTC appears to form a rising diagonal. Will wave 5 be ‘The Charm’?”

Finally, the analysts participation that there are even more factors lining up for bullish BTC momentum, including increased interest in Bitcoin options.

“Uptober is here and we are riding the bullish wave with style. BTC rockets past $28,000, marking a dynamic start to the week, month and quarter! We are diving into the heart of the BTC season and the risk is reaching the low-risk zone. The price is rising to its highest in more than a month, fueled by ETF (exchange-traded fund) optimism and seasonality. Options volume in late October teases exciting price action ahead.”

BTC is worth $27,948 at the time of writing, up 1.2% in the past 24 hours.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Featured image: Shutterstock/Elena Paletskaya/Sensvector