A widely followed crypto trader is warning that Bitcoin (BTC) could soon undergo an abrupt bearish trend reversal within days.

Pseudonymous trader and crypto bear Capo tells Bitcoin could soon collapse to a low of $30,000, according to its 792,900 followers on social media platform X.

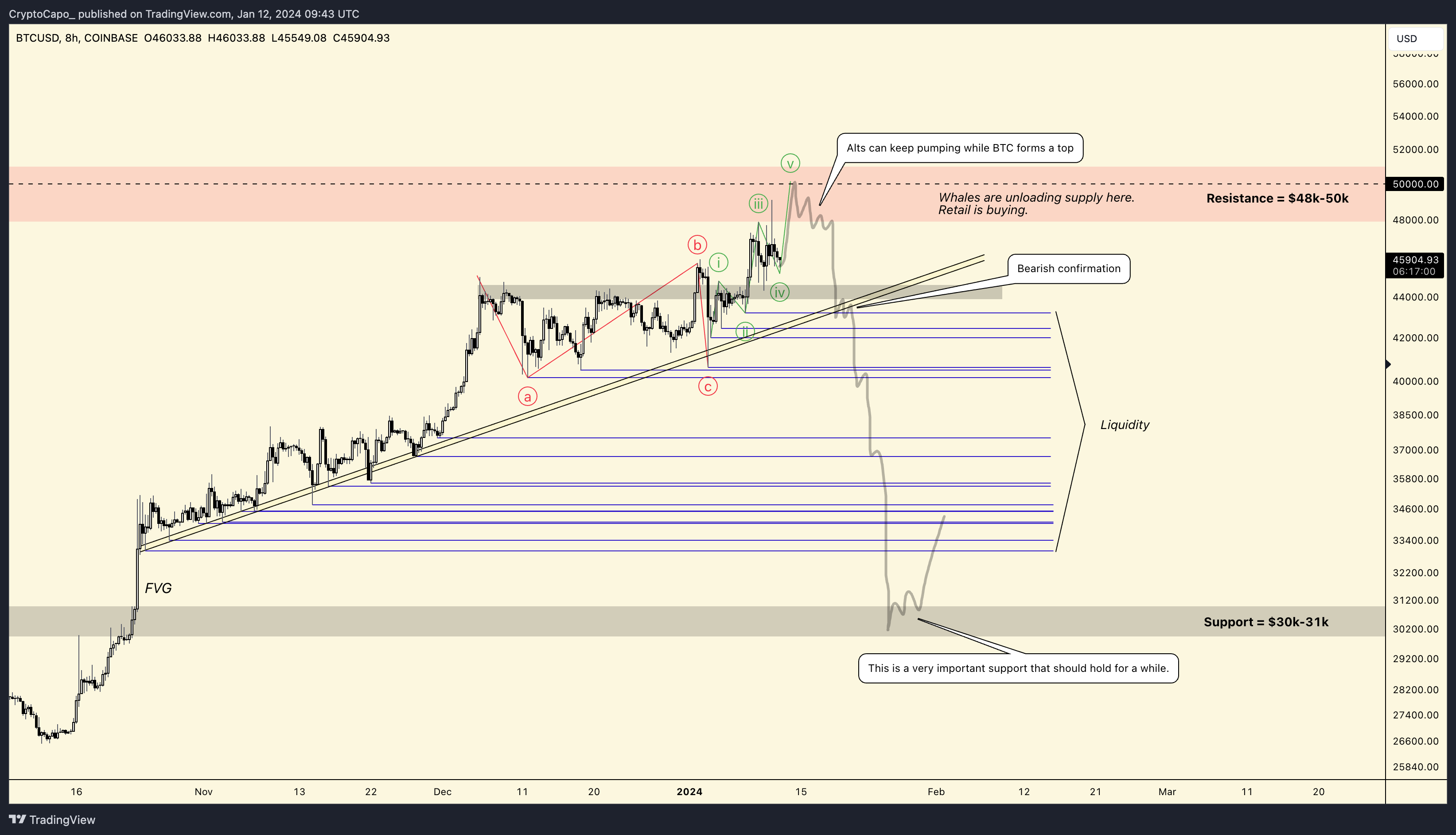

“Update.

BTC reached $48,000-$50,000 and ETH $2,500-$2,600. A final pump to $50,000 is possible. Then BTC should go sideways, while altcoins pump more (money flows to low-caps). After a few days, the entire market should turn around and dump.”

When the trader looks at his chart, he is using the Elliott Wave theory, which states that the main trend of an asset’s price moves in a five-wave pattern, while a correction occurs in a three-wave pattern.

According to Capo, the fifth wave could catapult Bitcoin to $50,000, leading to capital rotation into altcoins. The analyst also says that Bitcoin could then fall to the $30,000 to $31,000 range, which could act as support and lead to a possible price rise above $33,000.

Earlier this week, Capo predicted that the crypto market would rebound following news that the US Securities and Exchange Commission (SEC) is approving spot Bitcoin exchange-traded funds (ETFs). He predicted that the crypto market would peak after the rally, see a bearish trend reversal and print new cycle lows.

“After this, which should last a few days, the market should reach a very important local top. That is when I will open swing short positions, with the aim of hitting new lows.”

Bitcoin is trading at $42,596 at the time of writing, down nearly 7.44% in the past 24 hours.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: DALLE3