Data from the chain suggests that the Ethereum whales have shown a burst of activity recently. Here’s what these titans have been up to.

Ethereum Whale transactions are at their highest level since March

In a new after on X, market intelligence platform IntoTheBlock discussed how the ETH whales have become active recently.

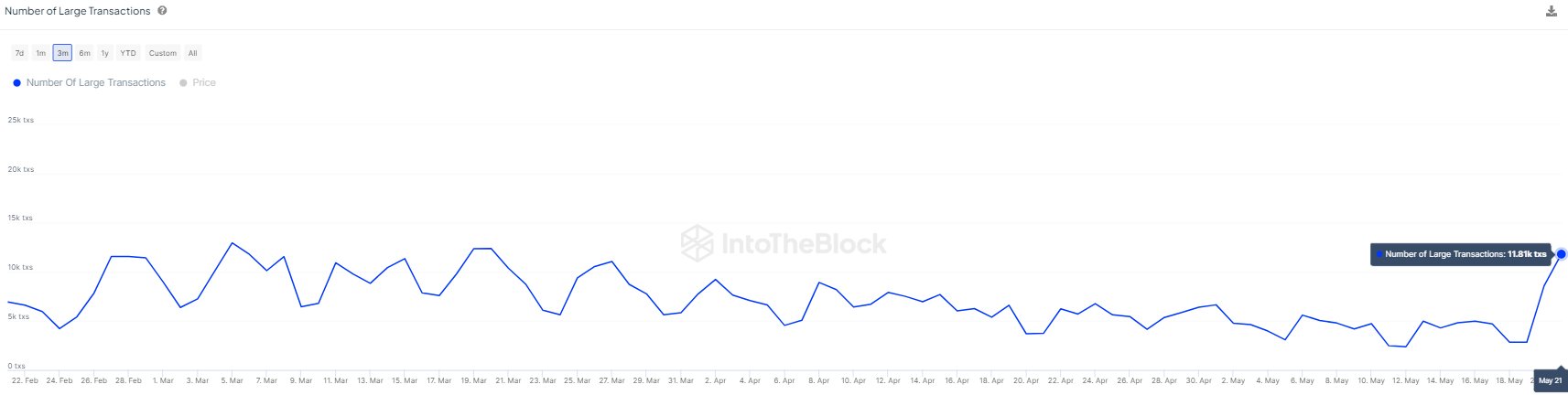

The on-chain metric of interest here is the “Number of Large Transactions,” which, according to the analytics firm, tracks the total number of Ethereum transactions on the network worth more than $100,000.

Related reading

In general, only whale entities can make such large single transaction moves, so such large transfers are associated with these giant investors.

As such, the Number of Large Trades indicator can tell us if this cohort is currently active. The chart below shows the recent trend in this Ethereum metric.

The graph shows that the number of large transactions for Ethereum has increased significantly recently. This suggests that the whales have increased their activity.

The whales have come to life as news surfaced that the ETH Spot Exchange Traded Funds (ETFs) could have increased their chances of approval. The hype in the market has caused ETH to experience a rapid rise, bringing its price back to around $3,800.

With all this happening in the market, it is only natural that these giant entities will start to reposition themselves. Since the size of this cohort’s trades is quite large, a large number of them happening together could be powerful enough to cause ripples in the market. Thus, ETH could likely witness near-term volatility if the current high whale activity continues.

However, the direction this volatility could take on Ethereum depends on whether these investors are buying or selling collectively. IntoTheBlock’s data has also provided hints about this, as the “Large Holders Netflow” chart below shows.

This indicator measures the net amount of Ethereum going into or out of the wallets of ‘major holders’. The analytics firm defines Large Holders as those who own at least 0.1% of the entire circulating supply of assets.

Related reading

The chart shows that the large holders have been participating in accumulation recently as the net flow for them has been positive. So it appears that the whales’ recent activity has involved buying nets.

It remains to be seen whether these giant entities will continue to exhibit this trend in the coming days, potentially helping fuel the rally.

ETH price

At the time of writing, Ethereum is hovering around $3,750, up more than 26% in the past week.

Featured image by Gabriel Dizzi on Unsplash.com, IntoTheBlock.com, chart from TradingView.com