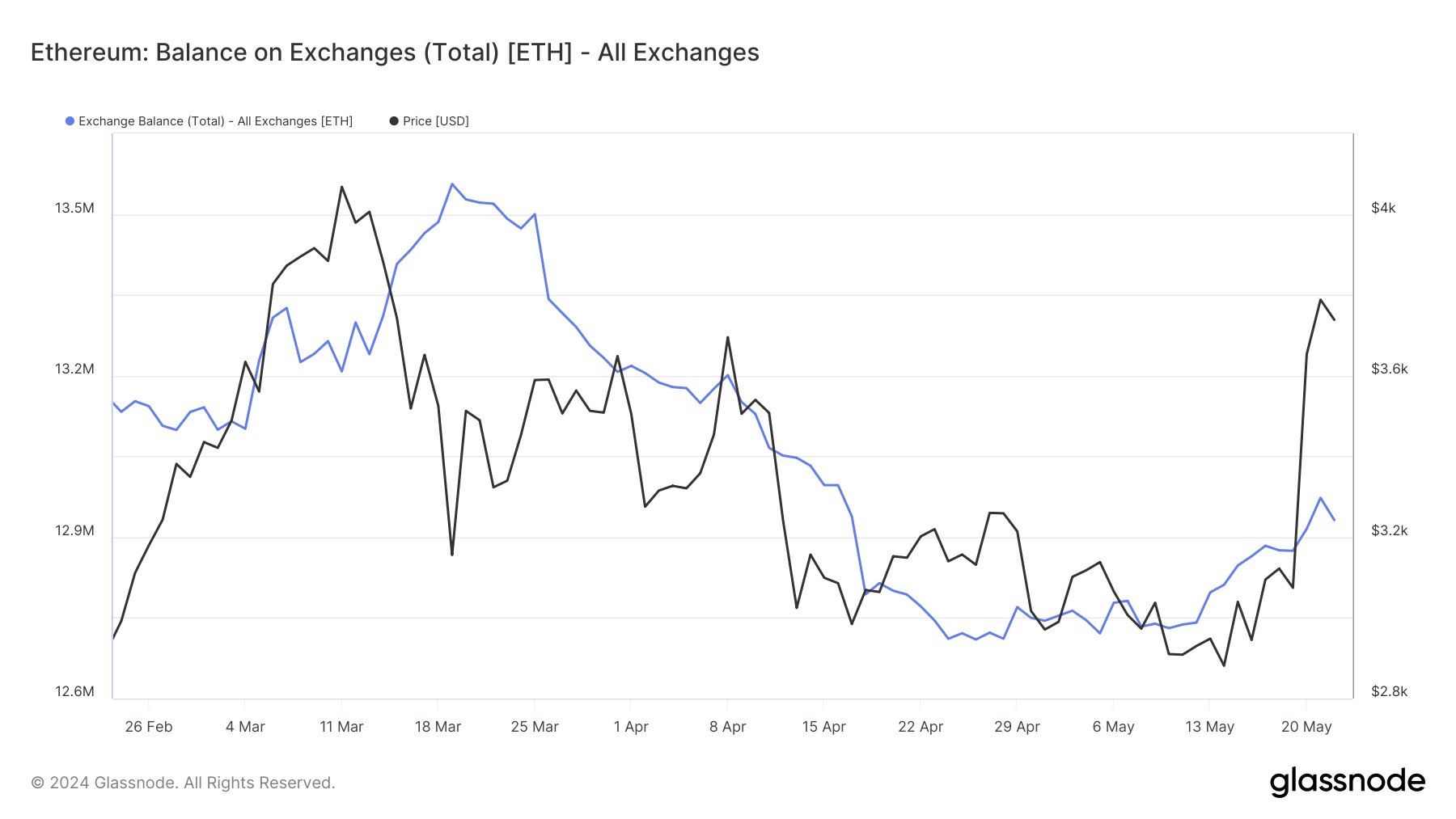

A widely followed crypto analyst says Ethereum (ETH) balances on crypto exchange platforms are spiking amid a potential sell-the-news event.

In a new thread, crypto trader Ali Martinez tells his 62,700 followers on the social media platform

“If you look at Ethereum balances on exchanges, you will see a spike in the number of tokens available to sell. Over 242,000 ETH have been moved to cryptocurrency exchange wallets in the past two weeks. This indicates increased trading activity on exchanges that could contribute to price volatility.”

According to Martinez, the massive ETH transfers are happening as a key signal – the Tom DeMark (TD) Sequential Indicator – flashing a sell signal on the leading smart contract platform’s daily chart, indicating the possibility of a sell-the-news event.

“The increasing ETH deposits in cryptocurrency exchange wallets indicate the possibility of a sell-off or spike in profit-taking. Meanwhile, the Tom DeMark (TD) Sequential indicator presents a sell signal on Ethereum’s daily chart.

The current green nine candlesticks on the daily chart suggest that a spike in selling pressure could cause ETH to retreat one to four daily candlesticks or even begin a new downward countdown before resuming the uptrend.

The TD Sequential Indicator is generally used to predict potential trend reversals for assets based on their previous closes.

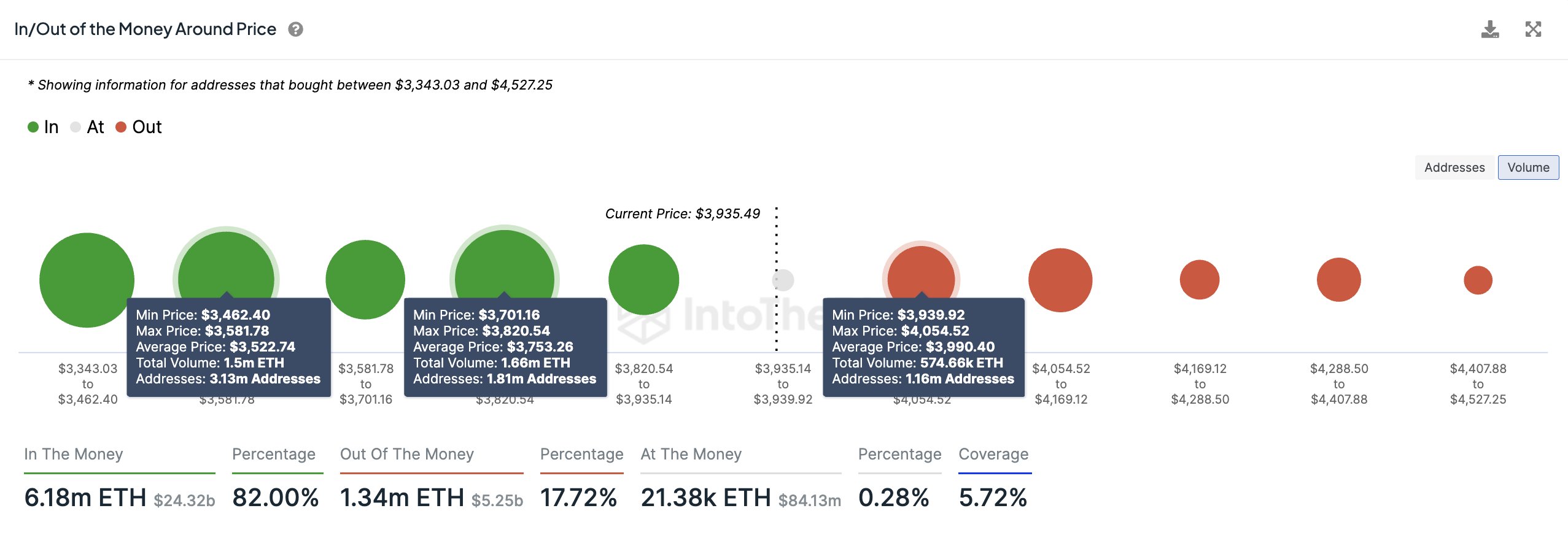

Martinez concludes saying that Ethereum has a path to the $5,000 price level if it prints a daily close above $4,170.

“The main resistance barrier for Ethereum is between $3,940 and $4,054. Here, more than 1.16 million addresses had previously purchased approximately 574,660 ETH.

If ETH overcomes this hurdle and pushes a daily candlestick close above $4,170, the bearish outlook will be invalidated. This could result in another upward countdown towards $5,000.”

Earlier this week, proposals to create ETH-based ETFs (Exchange Traded Funds) cleared a major regulatory hurdle, allowing the Ethereum ecosystem to grow.

Ethereum is trading at $3,732 at the time of writing, down 2.31% over the past 24 hours.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on X, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney