Bloomberg analyst Mike McGlone says there are indications that a severe contraction in the US economy is approaching.

The commodities expert says on social media platform

McGlone’s graph shows that the same difference between home sales and interest rates previously led to a massive crash in housing markets, followed by an eventual recession and a rate cut.

“The Housing Market Trough Could Be Even Deeper Than 2011 – Declining US existing home sales versus still-rising interest rates could be a clear sign of what has changed toward a trajectory of serious recession. My graph shows the 12-month average of home sales falling at a rate last matched during the Great Financial Crisis.”

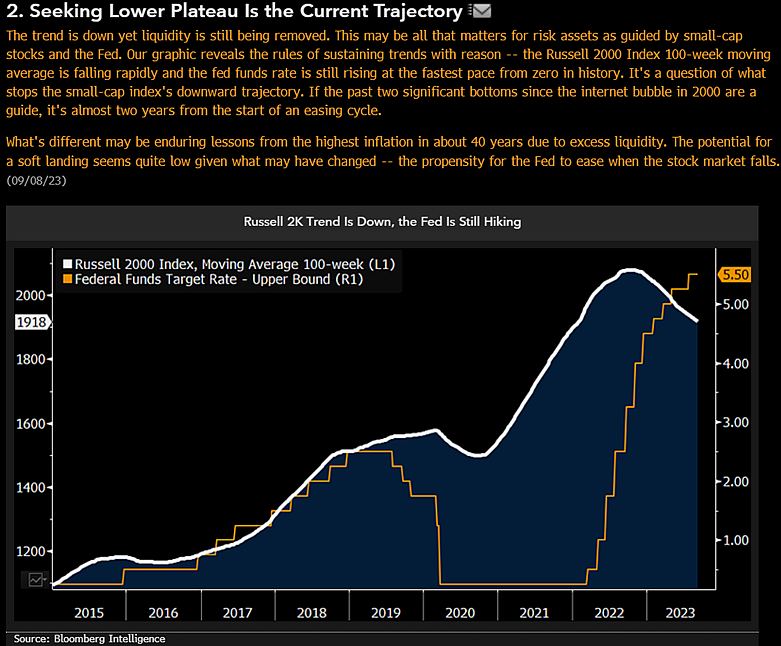

The analyst also looks at the Russell 2000, an index of the smallest 2,000 stocks in the Russell 3000 Index, which can be used to gauge risk appetite given the volatile nature of smaller market cap securities.

McGlone says the overall trend is down as liquidity declines, and that based on history, markets are still roughly two years away from an easing cycle that could help support prices.

“The search for a lower plateau is the current trajectory –

The trend is down, but liquidity is still being removed. This may be all that matters for risky assets, as led by small-cap stocks and the Fed.”

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Featured image: Shutterstock/Tuso949/Natalia Siiatovskaia