New data from Bitcoin brokerage firm River shows that the largest US hedge funds have collectively amassed billions of dollars worth of BTC exchange-traded (ETF) shares.

In a new thread on the social media platform X, River say that while BTC’s market cap is relatively small, many of the largest hedge funds in the US already have significant exposure to the crypto king.

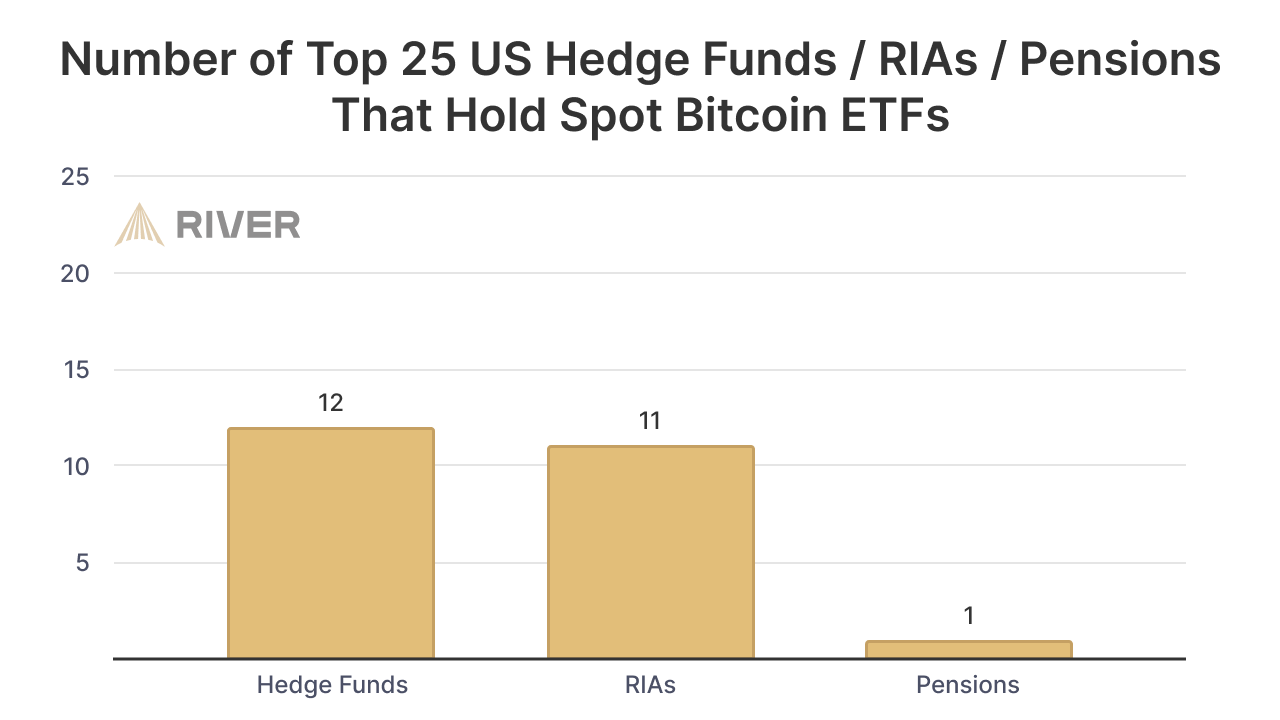

“Twelve of the 25 largest US hedge funds have a combined Bitcoin ETF exposure of more than $2.6 billion. Eleven of the 25 largest registered investment advisors (RIAs) also have exposure.

While Bitcoin is only a $1 trillion asset class.”

Some of the big hedge funds do that own According to River, as of March 31, Bitcoin ETFs include Millennium Management, Citadel Investment Group, Mariner Investment Group, Renaissance Tech and Point72 Asset Management.

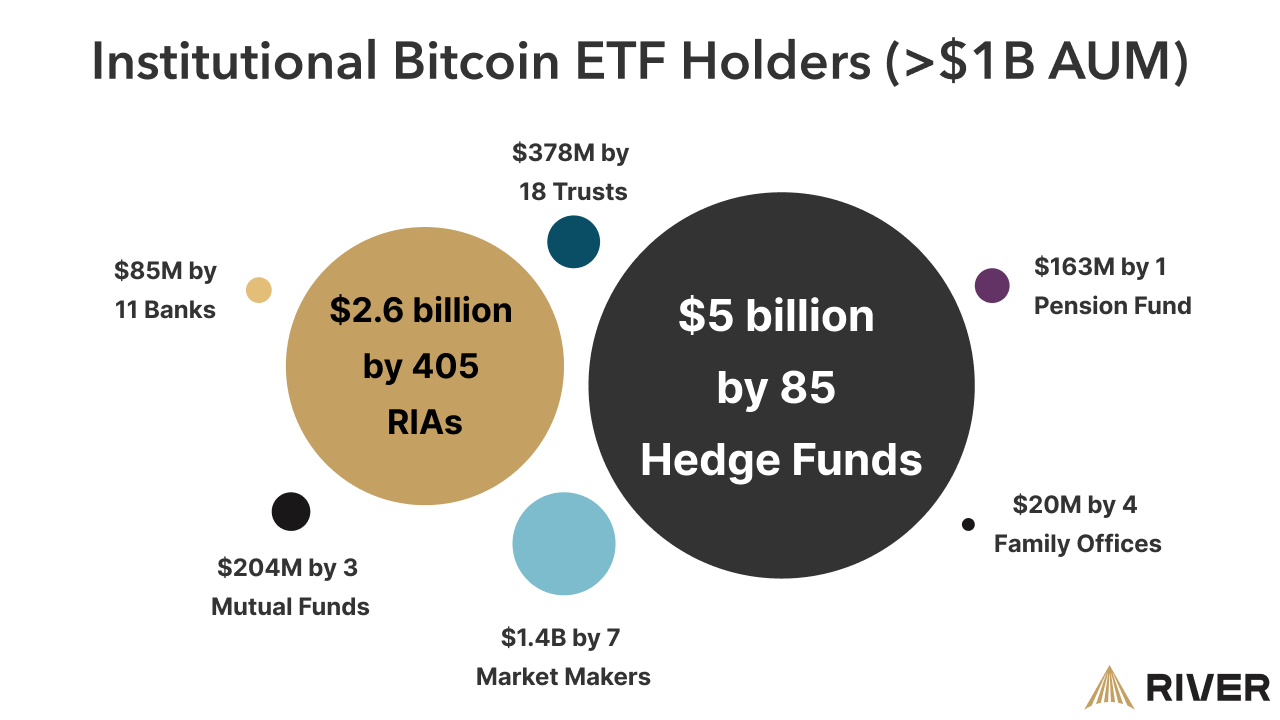

The real estate agency further notes that hundreds of RIAs have collectively invested billions of dollars in Bitcoin ETFs.

“RIAs have made relatively small allocations. But there are 405 advisors with over $1 billion in assets who have collectively allocated $2.5 billion to Bitcoin ETFs.”

Bitcoin is trading at $67,066 at the time of writing, down fractionally over the past 24 hours.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on X, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: DALLE3