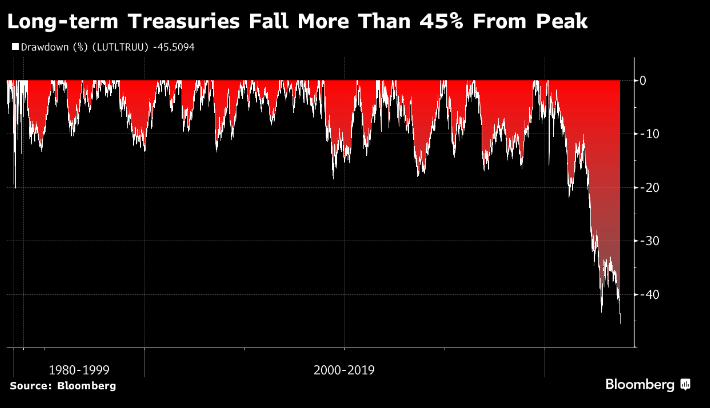

The recent steep decline in long-term bonds has sparked a flurry of debate among investors and financial analysts, drawing notable parallels to some of history’s most infamous market downturns. Bonds with a maturity of 10 years or more have witnessed a 46% reject since their peak in March 2020, which closely mirrors the 49% drop in US stocks in the wake of the turn-of-the-century dot-com bubble. The situation is even more alarming for 30-year bonds, which have tumbled 53% and are close to the 57% drop in stock prices in 2008. financial crisis.

Genevieve Roch-Decter, CFA, delivered this alarming trend to bring to light in a tweet on October 5, 2023, drawing a stark comparison between the current bond slump and the stock market crashes during the dotcom bubble and the 2008 financial crisis. Roch-Decter underlined that the declines in 10- and 30-year bonds are approaching the epic declines of stocks during these previous market downturns.

Source: Twitter&Bloomberg

Market reaction and implications

The resonance of this bond market slump and historic stock market crashes has fueled a sense of concern among investors, especially as bonds have traditionally been considered a safer investment than stocks. This downturn is not only eroding the capital of bond investors, but also has particular consequences for retirees and others who rely on bonds for stable income. The discourse among financial analysts and broader conversations on social media further highlight growing concerns about bond market stability.

The financial dialogue on platforms like Twitter reflects concerns about current bond market conditions. Notable financial analysts such as Roch-Decter and others have taken to social media to express their concerns and draw attention to the seriousness of the situation.

Comparison of bonds and stocks

The comparative analysis of the bond crisis with previous stock market crashes accentuates the scale and severity of the current bond market crisis. This situation has highlighted the need for a reappraisal of the traditional financial wisdom that bonds are a safer haven compared to equities. The dialogue between financial analysts and investors, as illustrated by the tweet from Roch-Decter and others, underlines the seriousness of the situation and raises questions about the broader economic implications.

The stability of the bond market is crucial for both individual and institutional investors. It is not only a cornerstone for those seeking stable income, but also a crucial part of the broader financial ecosystem. The current volatility in the bond market challenges the conventional financial narrative and raises critical questions about the long-term consequences for the broader financial market and the economy.

The ongoing discussions between financial analysts and the investment community underscore the need for a thorough examination of bond market stability and broader economic implications. The comparative data between the bond market slump and previous stock market crashes is a stark reminder of the potential risks inherent in financial markets. As the discourse continues, investors and financial analysts alike are closely watching the trajectory of the bond market and deliberating on the measures that can limit risks and stabilize the market going forward.

Image source: Shutterstock