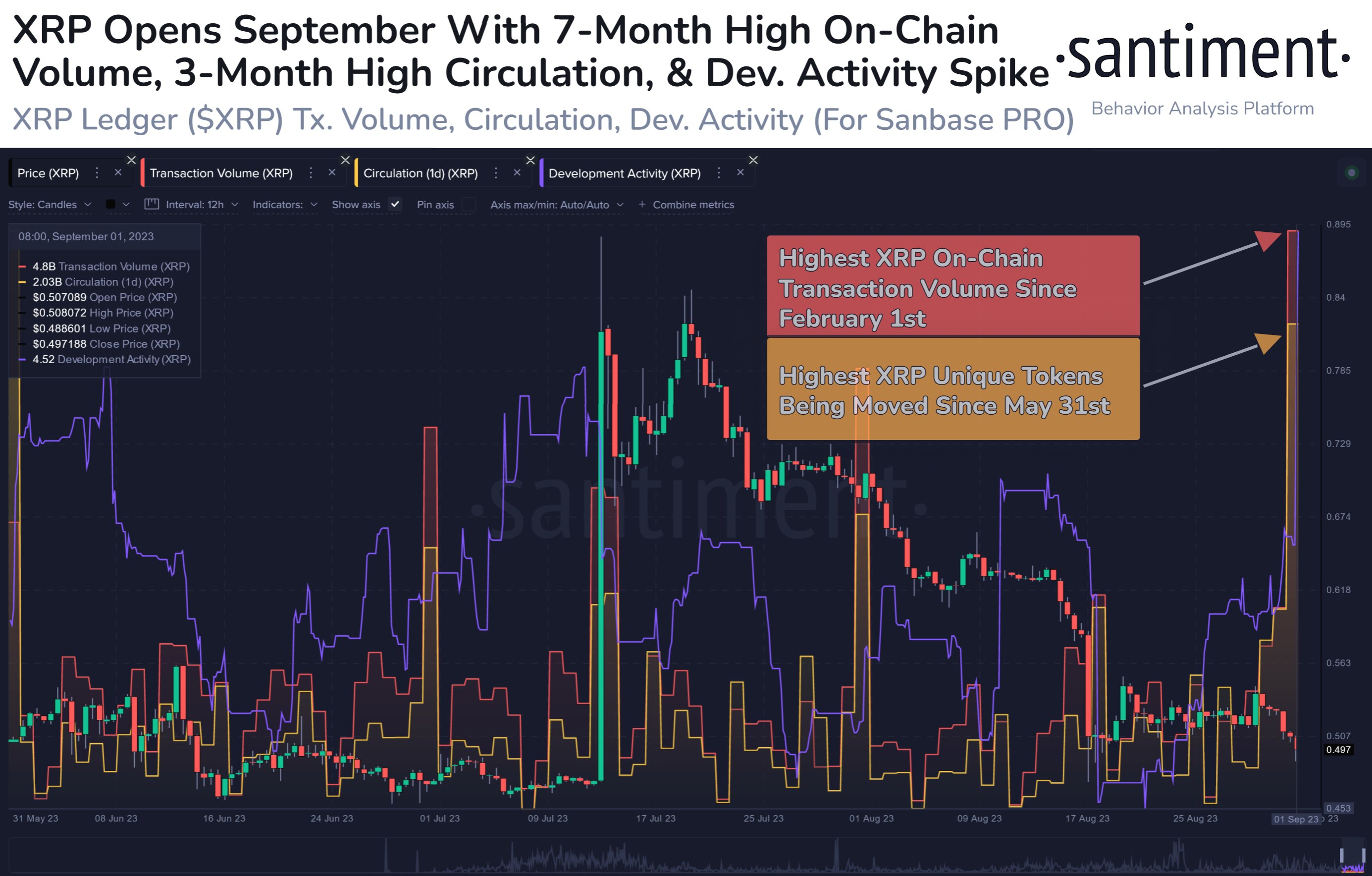

Blockchain analytics firm Santiment says XRP is seeing a huge surge in on-chain volume as development activity around the digital asset ramps up.

According to the market intelligence platform XRP, the token associated with Ripple Lab’s payment platform, kicked off September with the highest volume on the chain since February 1, along with a notable spike in development activity.

“XRP is seeing major utility spikes at the beginning of the month. In addition to today’s milestone highs in on-chain transaction volume (XRP 4.8 billion) and circulation (XRP 2.03 billion), development activity for the fifth largest cryptocurrency asset has also surged.”

XRP, whose automated sales on the open market were deemed non-securities in July following a lengthy legal battle with the US Securities and Exchange Commission (SEC), is trading at $0.496 at the time of writing, up 1.09% during the last period. 24 hours.

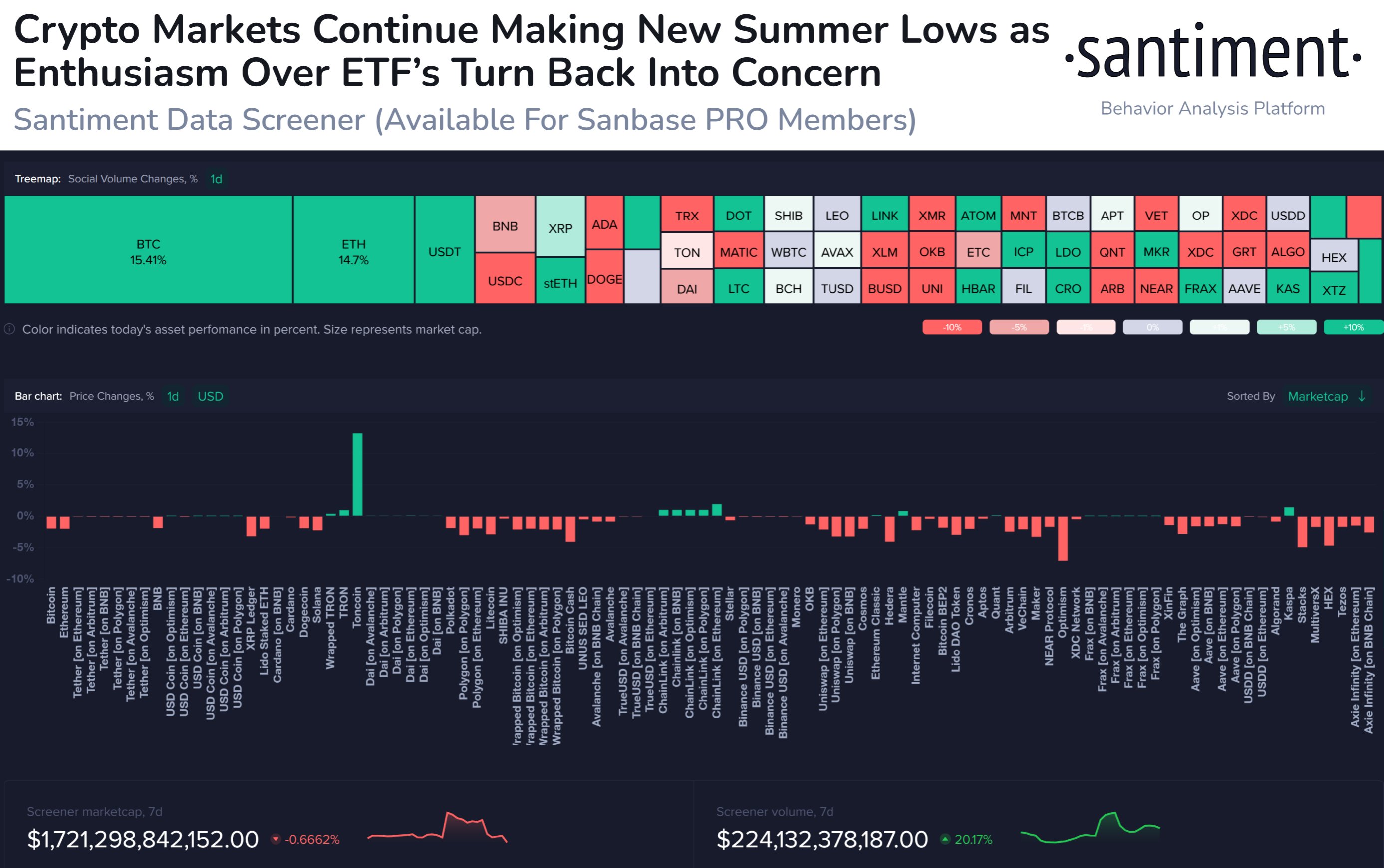

Looking at the crypto king Santiment say that Bitcoin (BTC)’s latest dip — with it falling to prices we haven’t seen since June — is due to the fear, doubt, and uncertainty (FUD) surrounding the potential rejection of BTC exchange-traded fund applications (ETF) in the spot market.

The analytics firm also notes that the FUD is sticking around even after the SEC lost a lawsuit against Grayscale over the rejection of the crypto firm’s bid to create a Bitcoin ETF.

“BTC started September with a drop to $25,400, the lowest price level since June 16. Traders are increasingly concerned that the SEC may not be willing to approve a spot Bitcoin ETF, even after Grayscale’s win. Expect FUD to dominate at least all weekend.”

Santiment is also looking at stablecoin offerings accumulated by crypto whales, as this metric could predict Bitcoin’s next move to $30,000 or $25,000.

“Whales are particularly indecisive when it comes to stablecoin accumulation. A proven method of predicting where crypto will go next is to analyze major wallets to see the ratio of stablecoins they hold. An increase in their purchasing power would be a sign of a recovery.”

Bitcoin is trading at $25,797 at the time of writing, up 1.2% over the past day.

Don’t miss a single beat – Subscribe to receive email alerts delivered straight to your inbox

Check price action

follow us on Twitter, Facebook And Telegram

Surf to the Daily Hodl mix

Featured image: Shutterstock/AnuStudio/INelson